How did prominent figures like former US Secretaries of State George Shultz and Henry Kissinger - and investors like Rupert Murdoch, the Walmart founders, and other prestigious names - ended up backing Theranos?

Former Silicon Valley unicorn Theranos—once valued at $9 billion— and its founder and CEO Elizabeth Holmes became one of the most spectacular fall from grace of the last decade - joining the exclusive club of multi-billion dollar business scandals like Enron and Bernie Madoff.

At the end of August 2021, Elizabeth Holmes is set to go to trial to defend herself against multiple counts of conspiracy and fraud in federal court in San Jose, California. According to Bloomberg, "the charges include lying to patients about the efficacy of her blood tests and misleading investors when she told them the company would generate $1 billion in revenue in 2015. In reality the tests had grave problems, and Holmes allegedly knew the company would only generate a few hundred thousand dollars that year."

CHANGING THE WORLD WITH PRESTIGIOUS BACKERS

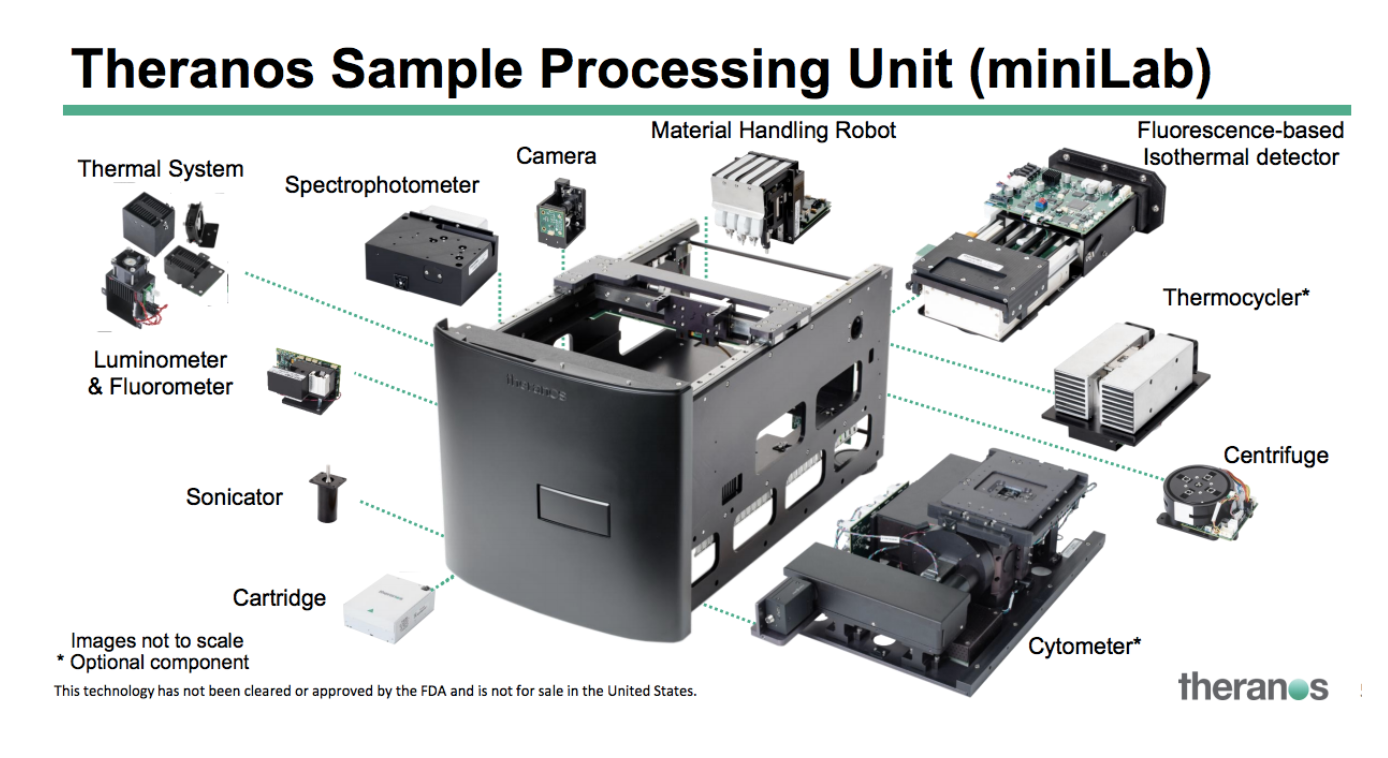

Theranos, at its inception, developed a bold idea that would change the world: a revolutionary blood-testing method all-contained in a small high-tech box called Edison — which promised to detect a range of illnesses with just a tiny drop of blood.Many prominent and distinguished public figures provided their support to the project. Former Secretaries of State George Shultz and Henry Kissinger sat on the Theranos board as well as James Mattis, retired US Marine Corps general who went on to serve as President Donald Trump's secretary of Defense. The Walton family, Walmart founders, provided $150 million. Rupert Murdoch invested $125 million. US education secretary Betsy DeVos and her family put $100 million in. Members of Atlanta's billionaire Cox family, members of a South African diamond dynasty, and Mexican tycoon Carlos Slim also invested (source).

THE FALL

In 2015, medical research professors along with investigative journalist John Carreyrou of The Wall Street Journal, questioned the validity of Theranos's technology.

The company then faced a wall of legal and commercial challenges from medical authorities, investors, the U.S. Securities and Exchange Commission (SEC), Centers for Medicare and Medicaid Services (CMS), state attorneys general, former business partners, patients, and more. The company was dissolved on September 4, 2018. On March 14, 2018, Theranos, Holmes, and former company president Ramesh "Sunny" Balwani were charged with fraud by the SEC.

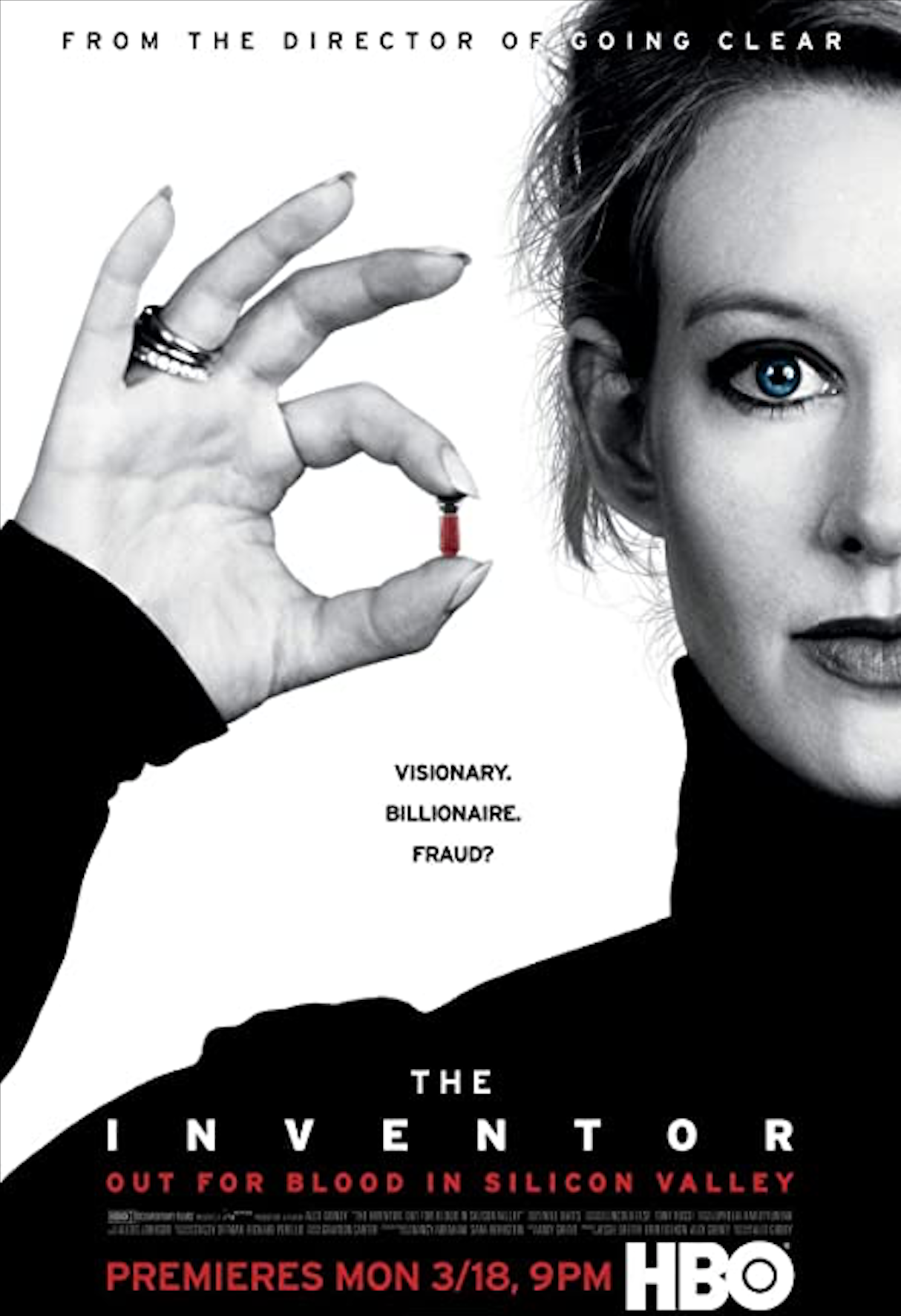

For a full overview of the story, watch the excellent HBO documentary investigating the rise and fall of Theranos directed by Academy Award winner Alex Gibney (Enron: The Smartest Guys in the Room).

KEY LESSONS FOR INVESTORS

Every serious investor on earth should have already heard about a hundred times of the importance of thorough due diligence before committing funds to a project. So why did this happened? Why did so many prominent figures and professional investors decide to invest in Theranos?Whether you are Venture Capitalist or a seasoned private investor, you should try to understand why and how the Theranos debacle ever happened.

What are the key lessons for investors?

1. Investment Decision Driven By Your Instinct

You strongly believe you have found the next unicorn led by the new Steve Jobs because you are certain you can identify the archetypal Steve Jobs personality at play with this new charismatic entrepreneur. You know this founder "has it", you have been in this game for a while.Theranos founder Elizabeth Holmes idolized Steve Jobs to a point where she adopted his mannerisms, dressing everyday in a black turtleneck just like him. She also made it very personal and emotional when she was pitching to investors. She focused the business pitch around her, more than the company and its product and technology. Investors were drawn to her character, her personal story, her idealism and strong determination, losing sight of the actual business idea she proposed, and its actual feasibility.

2. FOMO

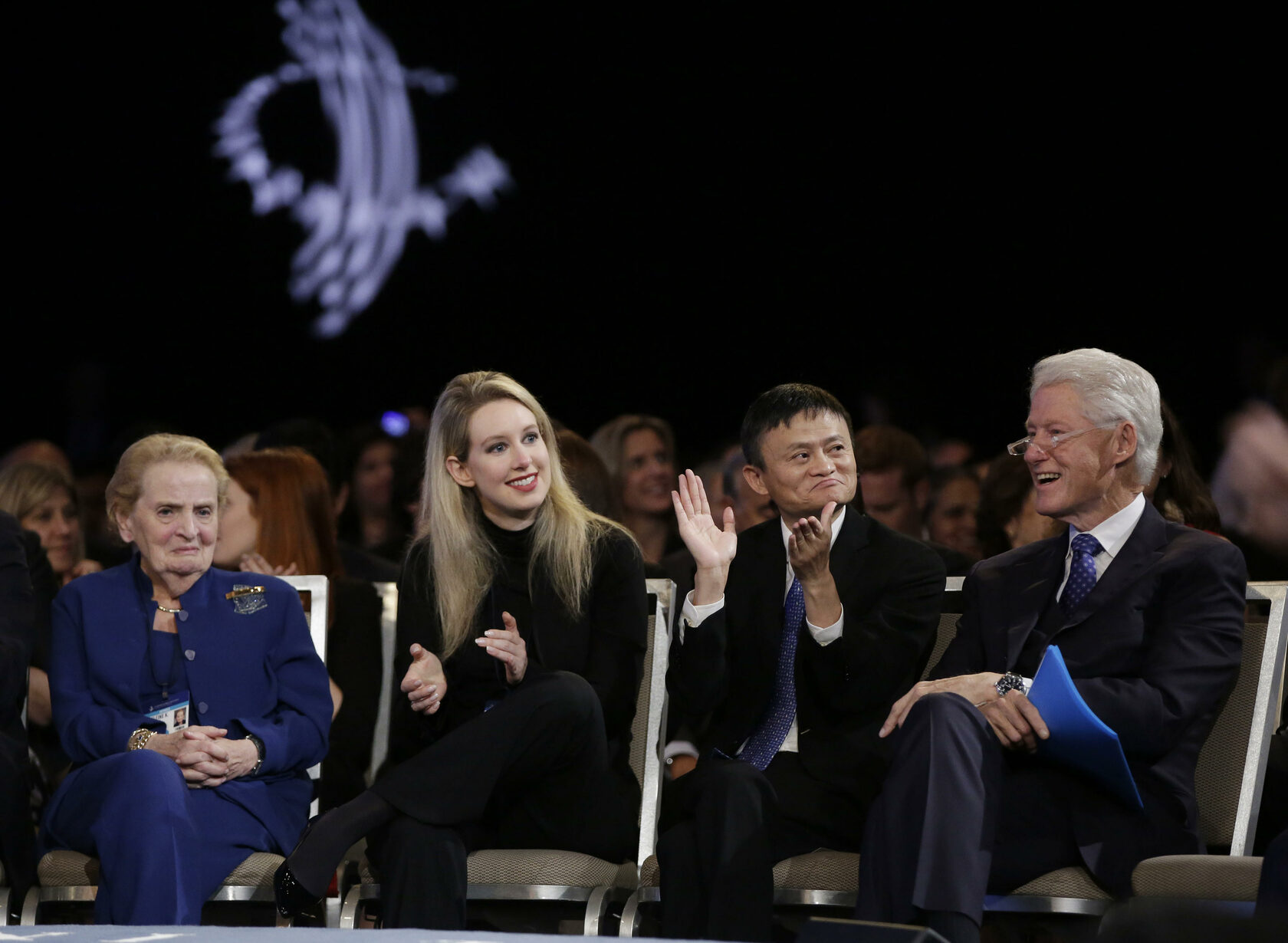

Fear Of Missing Out. Social pressure. The big guys are weighting in. If these guys are sitting with her on stage praising her business, pledging their reputation and money, well they know what they are doing, and I can rely on their rigorous due diligence. They do it all the time.The prestigious list of Theranos supporters and fans - James Mattis wanted to bring the Edison machine on the battlefield to save lives - convinced investors that this non-existing technology was going to achieve incredible results that would change the world. Who would want to miss such an opportunity? FOMO led investors to rely on sentiment and social pressure to make an investment decision, instead of conducting their own thorough well informed due diligence.

Madeleine Albright, Elizabeth Holmes, Jack Ma, President Clinton - Credit: UPI / Alamy

3. Unqualified Management

Elizabeth Holmes is a university dropout with zero scientific expertise. The Board of Directors was mainly composed of prestigious names from the military and foreign affairs with no track record or expertise in biology or medical sciences.This lack of scientific expertise at the top of a self-proclaimed revolutionary medical company should have been a major red flag for investors.

4. Extreme Secrecy

The level of secrecy in Theranos was beyond reasonable. Yes a technology company - like it was the case at Apple with Steve Jobs - requires a certain level of secrecy and Chinese walls to protect valuable IP during a product development. But Holmes went far beyond at Theranos. It was like running a national intelligence agency. The HBO documentary brilliantly shows how secrecy was turned into paranoia and covert control of employees. Not only Holmes was secretive with Theranos’ employees, but also with the press and investors.

No one knew how the machine worked. Employees were only given limited information about the machine and were only aware of the parts assigned to them, thus preventing them from sharing information with each other. Descriptions provided to the press and investors were often vague, and product demonstrations were not held with investors in the room. Investors didn't have full access to the technology and - financial records of the company.

Once again, this candid level of trust from investors was only made possible thanks to the extraordinary narrative, emotions, and prestigious support that Holmes had managed to build behind Theranos.

5. No One Would Listen

In his book No One Would Listen, the exclusive story of the Harry Markopolos-lead investigation into Bernie Madoff and his $65 billion Ponzi scheme, we learn that Madoff was doing years before this financial disaster unravelled. Unfortunately, no one would listen. Until it was too late, the damage of the world's largest financial fraud ever was irreversible.

In Theranos’ documentary The Inventor: Out for Blood in the Silicon Valley, scientific experts in the field were interviewed and stated that Theranos' idea was physically impossible to create. So there was a lot of information out there that could have been used by investors to question and challenge the Theranos business case. But it did not happen. In-depth analysis of competitors, interviews of qualified scientific experts and more, could have informed a more rigorous due diligence process. Investors did not search, and were not willing to listen. They loved the idea too much.

CONCLUSION

Finally, the key lesson is that investors should always conduct a rigorous due diligence process - especially when they are tempted to only listen to their instinct, their confidence, their FOMO, the crowd, the emotional story, etc.To be able to properly and seriously challenge an investment opportunity - regardless of the prestige of the founders and backers - investors should always gather strategic investment intelligence from all possible sources (competition, current and former employees, experts in the field, analysts, other investors, academics, administrations, and more) to develop their own informed judgement of an investment opportunity. Of course there is no recipe for 100% success. But there are ways to mitigate risks and reduce uncertainty.

* * *

This article was written by Julien Artero, Managing Director at Kalita Partners, with the precious research support of Giulia Tesauro.

Copyright - Kalita Partners Ltd - 2021