The mid and long-term effects of the pandemic on M&A

Kalita Partners - Summer Series 2021 - Part 4/4

(Read Part 1, Part 2, Part 3)Disinformation — the deliberate use of untruths or half-truths to confuse, incite, or inflame — can derail a carefully planned and timed M&A transaction or IPO. Businesses are prime targets of disinformation campaigns. Disinformation can destroy a company's reputation, hurt profitability, and even disrupt financial markets. The Covid-19 pandemic has exacerbated the spread and sophistication of disinformation online, now impacting all sectors and businesses, especially during crucial events such as transactions.

Someone may be strongly motivated to influence the outcome of a transaction event: a group of investors, a communication campaign covertly sponsored by a competitor, a network of political activists, a foreign government, a criminal organisation, or a Reddit forum like WallStreetBets playing with Meme Stocks.

These various actors are trying to influence or control the narrative of a given situation, for example the potential acquisition of a business by a Buyer. Networks of bots and trolls can be deployed on Social Media to artificially amplify certain pieces of information and distort the general perception of the given event.

Ultimately, traffic manipulation leads to information manipulation

In the early assessment stage of potential businesses acquisition, Buyers may encounter challenges in the form of social media-generated disinformation and negative rumours about the company they are considering, as well as about the brand reputation of the business.

Buyers need to carefully analyze and assess if the information they are dealing with is authentic or a the result of artificial social media promotion, disinformation campaigns and/or influence operations.

A few recent examples have shown the impact of social media disinformation and/or activist campaigns on business and markets:

# In 2018, Centrale Danone, the local subsidiary of the French food giant in Morocco, was targeted by a large-scale boycott campaign. But despite its activist appearance, this campaign seems to be based on significant technical and financial resources incompatible with a sole spontaneous or popular mobilisation.

The study of the characteristics of the April 2018 boycott in Morocco highlights the presence of technical means (anonymization of pages, astroturfing, bots, spam, etc.), narrative (ad hominem attacks, language elements, etc.) and operational (structured, coordinated, funded and hidden network, etc.), widely used in information manipulation campaigns.

An investigation on Twitter by specialist firms revealed that the existence of more than 800 bots were in place to support the boycott of Danone in Morocco, all created one month before the boycott started. The whole anti-Danone campaign appeared very well coordinated, allowing mass-publishing in under an hour to obtain viral results in low-audience hours. A number of posts were also sponsored on social media to achieve a significant number of interaction for each post.

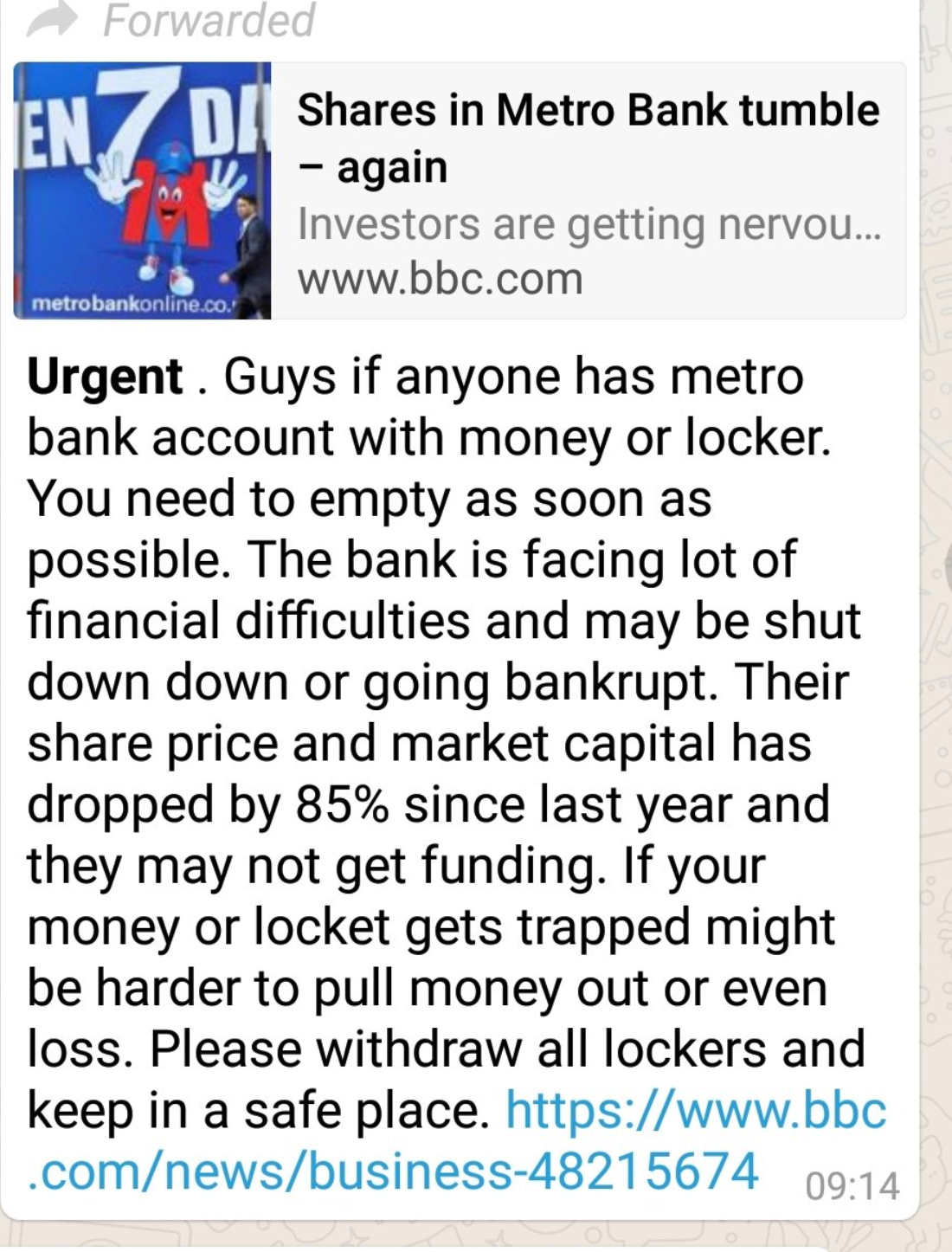

# In May 2019, Metro Bank lost 9% of its share value in one day as a result of rumours spread amongst its customers through WhatsApp.

A hoax message sent via Whatsapp on a Saturday morning claimed that the bank was on the brink of bankruptcy. Later in the afternoon, long queues of panicked bank customers formed at five or six branches of the challenger bank, which had 67 locations across London and the South East at the time. By the next Monday, the damage to the share price of the bank was done.(Picture: source)

# In January 2021, amateur activist investors rallied themselves on social media, starting from WallStreetBets to buy shares of GameStop - an American brick-and-mortar retailer that specialises in video games, consumer electronics, and gaming merchandise - skyrocketing its market share value.

The big funds who were deploying short strategies against the share price of the loss-making GameStop reported huge losses. For example, CNBC and The Wall Street Journal reported that hedge fund Melvin Capital Management lost 53% during that month. "For those short-selling hedge funds, the losses mounted up. On the 29th of January 2021, data from fintech company S3 Partners showed that short-selling hedge funds had suffered a year-to-date market-to-market loss in GameStop of $19.75 billion. In the week following GameStop’s reaching its peak share price, around $36 billion of value was wiped off of its value, as well as that of four other “meme” stocks that were being traded in a similar fashion." (Source: Game Stop, What happened and what it means).

***

What we have learned from M&A clients is that it is important to obtain a comprehensive and detailed historical background of the Seller’s owners and management team.

Who are the key persons for the Seller company, what were their social media presence and market activities in the past three to six months prior to the company being put for sale? Are there any early signs online of influence or disinformation campaigns being deployed?

Many have learned the hard way that pre-diligence analysis of the reputation of the Sellers, the perception of the Seller company’s customers and the stability of the market is which the Seller operates, produce for the Buyer invaluable knowledge for the selection of the company to be acquired and to conduct informed pricing negotiations.

A few years ago a US pharmaceutical bought a small, regional competitor who was developing drugs and launched them on the market. There were complaints from patients of adversarial effects from the medication circulating online. During post-acquisition, there were many claims against the company, which the Buyer had to settle. Prior to the acquisition, the Buyer paid unfortunately little to no attention to the circulating rumours and did not have a good grasp of the likely and existing legal claims against the entity associated with the sold medicines - after all there were no provisions included in the audited accounts. As the Seller was wound down, the Buyer had no recourse against the Seller and the attempt to sue the Seller’s auditors under the accounting warranties was unsuccessful.

Steps that Buyers can take during the M&A process - to identify weaknesses and mitigate the risks of deal information leakage, or rumours due to hostile activity - include:

- As part of the initial Target screening deploy a cross-platform semantic deep analysis to detect disinformation and artificial promoted narratives. The larger the company to be acquired, the longer the period of time to complete the screening process.

- During the diligence and post completion phases, perform continuous monitoring and evaluation of potential influence and disinformation campaigns in place or building up. Seek to detect new campaigns linked to previous ones based on digital evidence, artefacts of actors and their modus operandi.

- Post-completion conducting full intelligence-led analysis using forensically sound protocols.

Paul Wang, CEO and Co-founder of ZeNPulsar, and Senior Adviser Cyber Investigations, Kalita Partners:

“Information is Value. Today, social media represents the fastest-evolving medium spreading information. Corporates are at risk of having their reputation impacted by disinformation and harmful narratives, spread in a glimpse of a second in the information space.

Fake news has 70% more chances to be retweeted. Nowadays, traditional, and classical due diligence activities in M&A need to be strengthened by new in-depth analysis focused on data present in the information space. Using Deep-tech, artificial intelligence and machine learning powered systems, such as ZeNPulsar products, enables Buyers to perceive the true nature of information, understand Target company’s reputation before deal negotiation starts.

This in-depth analysis will empower Buyers to identify authentic positive news as well as potential adversarial harmful narratives. The identified relevant information resulting from the analysis, authentic and especially inauthentic ones may constitute a risk to be assessed and carefully evaluated prior to the acquisition process. It may also bring leverage in the deal negotiation.

Bill Gates once said that "bringing together the right information with the right people will dramatically improve a company’s ability to develop and act on strategic business opportunities". American entrepreneur Victor Kiam also said that "Information is a negotiator’s greatest weapon" - which is especially true in M&A situations."

* * *

This article was written with the support of Paul Wang, CEO and Co-founder of ZeNPulsar, and Senior Adviser Cyber Investigations, Kalita Partners.

This series is authored by Kalita Partners with the contribution of Kamelia Kantcheva, Julien Artero, Giulia Tesauro and additional research support from Marine Pichon.

Copyright Kalita Partners Ltd 2021